Miami Car Accident Lawyer | Miami Car Accident Attorney

Treating Every Client Like They’re Our Only Client

Because of our dangerous roads, there is a very good chance that every American will be involved in a traffic crash at some point in their life. That chance is increased if you live in Florida. Our sunshine state consistently ranks at or near the top of the list when it comes to car accidents per state.

If you have been involved in a car accident, it is important that you seek representation immediately to have someone to protect your interests and guide you through the process. Miami injury lawyers from Flanagan & Bodenheimer Injury & Wrongful Death Law Firm can guide you through the claims process in a way that allows you to treat your injuries and address the emotional aspect of the collision while still seeking legal recourse as soon as possible.

Our firm is proud to offer trustworthy legal representation so all our clients have to focus on is resting and healing from their injuries. You can expect to meet with a Miami injury lawyer directly and receive the compassion and level of care you deserve after a traumatic experience.

Contact our office online or by phone to schedule your free consultation at (305) 638-4143 with a Miami car accident attorney. Our team strives to remain as accessible as possible so we can answer your questions as you have them.

Table of Contents

- About Our Miami Car Accident Lawyers

- Insurance Companies We’ve Handled Claims Against

- Types of Miami Car Accident Claims We Handle

- Common Car Accident Injuries

- Florida Car Accident Statistics

- Understanding Florida Car Accident Laws

- No Fault Insurance in Florida

- Comparative Negligence in Florida

- Leased Car Accidents in Miami

- What to do if Involved in a Car Accident in Miami

- The Importance of Uninsured Motorist (UM) Coverage in Miami

- Why You Need a Car Accident Attorney

- Complimentary Case Evaluation

Our Miami Car Accident Lawyers

Our attorneys have years of experience winning and successfully handling car accident cases here in Miami. Our car accident lawyers, Michael T. Flanagan, and Zachary D. Bodenheimer have recovered tens of millions of dollars for victims of car accidents. In 2019, Michael T. Flanagan obtained a “Top 100 Motor Vehicle Accident Settlement in the United States” as ranked by Verdict Search. In addition, in 2018, Zachary D. Bodenheimer obtained one of the largest motor vehicle brain injury verdicts in the State of Florida: $10,500,000.

Successful Track Record with Top Car Insurance Companies

While we have handled multi-million dollar accident cases, our car accident lawyers have also handled smaller automobile accident cases where helping the victim was just the right thing to do. Our attorneys have gone to trial in car accident cases against State Farm, Geico, Progressive, the City of Miami, and others. We have handled car accident cases against many of the largest car insurance companies in Florida including, but not limited to:

- GEICO

- State Farm

- Progressive

- Allstate

- AIG

- United Automobile Insurance Company

- Chubb

- AAA

- Auto Owners Insurance Company

- Southern Owners Insurance Company

- Dairyland Insurance Company

- Kemper Insurance Company

- Nationwide Mutual Insurance Company

- Travelers

- USAA

- Liberty Mutual

- Farmers

- Am Trust Insurance Company

- Berkshire Hathaway Gaurd

- Mercury

- National General

- And others

Types of Miami Auto Accident Claims We Handle

Some of the car accident claims we’ve handled include:

Miami I-95 Accidents

Miami’s bustling highways, including I-95, often witness high-speed collisions, multi-vehicle crashes, and traffic-related incidents. Express lane diving is a common occurrence on I-95 in South Florida, leading to multiple car accidents every year. Our team of Miami car accident lawyers is experienced in pursuing compensation for victims of I-95 car accidents throughout South Florida.

Miami Drunk Driving Accidents

Drunk driving continues to pose a significant threat on Miami’s roads. Our attorneys are dedicated to holding intoxicated drivers accountable, seeking justice and compensation for those affected by the devastating consequences of drunk driving accidents.

It is important to remember that in drunk driving accidents there may be two legal cases – a criminal case brought by the State Attorney, and a civil case brought by an injured victim. It is crucial that you speak with a Miami car accident attorney to make sure your civil rights are protected.

Miami Rollover Accidents

Rollover accidents can result in severe injuries and extensive property damage. Whether caused by vehicle defects, road conditions, or reckless driving, our car crash lawyers are equipped to investigate the causes and pursue rightful compensation for victims of rollover accidents.

Miami Texting & Driving Accidents

Distracted driving, particularly texting while driving, is a growing concern on Miami’s roads. Our attorneys understand the nuances of these cases, working diligently to prove negligence and hold distracted drivers responsible for the harm caused in auto accidents.

Miami Rideshare Accidents

With the prevalence of rideshare services like Uber and Lyft, accidents involving these vehicles require specialized legal knowledge. We handle rideshare accident cases with a focus on determining liability and pursuing compensation from the rideshare company or at-fault driver.

Miami Failure to Yield Accidents

Failure to yield accidents can lead to T-bone collisions, intersection crashes, and other serious incidents. Our auto accident lawyers meticulously examine the circumstances surrounding these accidents, establishing fault and advocating for fair compensation for victims. Failure to yield accidents can occur between cars, trucks, bicyclists, and pedestrians.

Miami Rear End Car Crashes

Rear-end collisions are a common occurrence on Miami’s congested roads. Whether due to distracted driving, tailgating, or sudden stops, these accidents can result in serious injuries. While these types of crashes may seem like a straightforward insurance claim, they frequently can become complicated and require significant attorney effort to obtain fair compensation for the accident victim.

Miami Rental Car Accidents

Accidents involving rental vehicles introduce additional complexities related to insurance coverage and liability. Our attorneys are well-versed in handling leased car accidents, ensuring that the legal nuances of the leasing agreement are carefully considered in pursuing a successful case.

Fatal Car Accidents

Families affected by fatal car accidents may be eligible to pursue wrongful death claims. These claims seek compensation for damages such as medical expenses, funeral costs, and the emotional toll of losing a loved one. At Flanagan & Bodenheimer, our attorneys approach fatal car accident cases with empathy, recognizing the unique challenges families face during this difficult time. Whether it’s a negligent driver, a defective car product, or poorly maintained roads, our legal team strives to hold responsible parties accountable for their actions. Learn more about wrongful death claims here.

While we can’t guarantee the outcome of any case, we can promise to fight as hard as we can to maximize the amount of money we get for you.

Common Miami Car Accident Injuries

Our personal injury lawyers have handled hundreds of car accident cases. We have handled cases involving many different injuries caused by car accidents. Below is a list of the most common car accident injuries we have handled in our practice:

- Herniated Discs: Probably everyone has heard of “whiplash.” Whiplash is a soft tissue injury resulting from the rapid back-and-forth motion of the head and neck during a collision. Symptoms include neck pain, stiffness, headaches, and sometimes, blurred vision. However, frequently in car accidents people receive an injury called a herniated disc. A herniated disc is an injury to the joints in the spine. A herniated discs and other spine joint injuries frequently cause irritation and compression on the nerves that travel through the spine which can cause painful neurological symptoms. Herniated discs very frequently occur in car accidents.

- Broken Bones & Fractures: The force of impact in a car accident can lead to fractures or breaks in bones throughout the body. Symptoms include swelling, pain, deformity, and restricted mobility.

- Head Injuries: Head injuries can range from concussions to traumatic brain injuries (TBIs), often occurring when the head collides with a surface or object during an accident. Symptoms may include dizziness, confusion, memory loss, and in severe cases, unconsciousness.

- Back & Spinal Cord Injuries: The impact of a car accident can cause damage to the spine, resulting in injuries ranging from herniated discs to paralysis. Symptoms may include back pain, loss of sensation, and motor function impairment.

- Soft Tissue Injuries: Soft tissue injuries involve damage to muscles, ligaments, and tendons and can result in pain and reduced mobility. Symptoms may include swelling, bruising, and persistent pain.

- Emotional Distress: Car accidents can lead to emotional trauma, including anxiety, depression, and post-traumatic stress disorder (PTSD). Symptoms may include flashbacks, nightmares, and emotional distress affecting daily life.

- Burn Injuries: Burn injuries are not only physically debilitating but also emotionally challenging. Victims may require extensive medical treatments, surgeries, and therapy to cope with both the visible and invisible scars.

- Amputation: Amputations resulting from car accidents have profound consequences on an individual’s independence and overall well-being. The emotional and physical adjustments can be daunting, requiring comprehensive lifelong support.

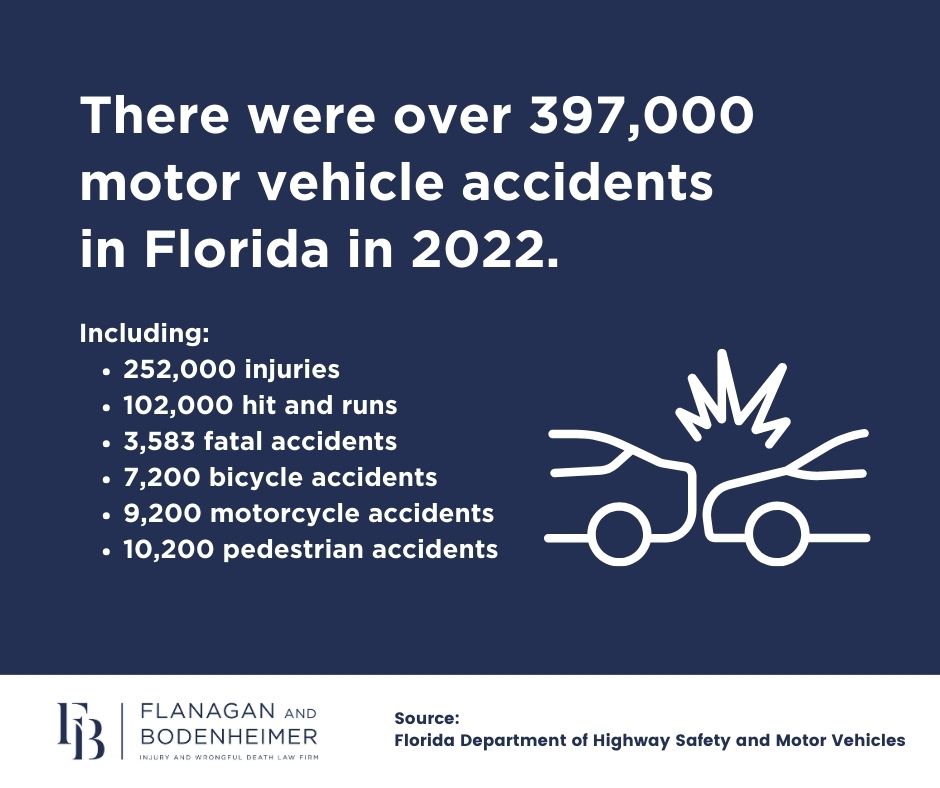

Florida Car Accident Statistics

The Florida Department of Highway Safety and Motor Vehicles reported over 397,000 motor vehicle accidents in 2022. These accidents resulted in over 252,000 injuries and 3,583 fatalities. These numbers include over 7,200 crashes involving a bicycle, over 9,200 crashes involving a motorcycle, and over 10,200 crashes involving pedestrians. These figures also include over 102,000 hit and run accidents.

Source: https://www.flhsmv.gov/traffic-crash-reports/crash-dashboard/

Understanding Florida Car Accident Laws

No-Fault Insurance – Personal Injury Protection Insurance

Florida is one of 12 states that operates under a mandatory no-fault insurance system. No-fault insurance systems are self-explanatory in that each driver’s insurance company covers their own driver’s medical bills and lost wages, without assigning a fault rating like fault-based states do.

Personal Injury Protection (PIP) is Florida’s “No-Fault” insurance. When you are involved in a car accident, regardless of who is at-fault, your personal injury protection car insurance will pay for up to $10,000 of your economic damages. That means some of your medical bills and lost wages are paid for by your car insurance even if the accident was someone else’s fault. See Florida Statutes Section 627.736 for more information.

The purpose behind PIP insurance is to make sure that the first responders, hospitals, and initial medical providers can be certain to be compensated in the event of an accident. It also provides some reassurance to drivers that if they are involved in a crash, they can obtain medical treatment without having to worry about immediately being in medical debt.

Bodily Injury Insurance

There are many different types of insurance coverage at issue in car accidents. Bodily injury insurance coverage is a liability insurance coverage. That means that if you cause or are liable for a crash, your bodily injury insurance coverage pays for the bodily injuries you caused to others. Bodily injury insurance covers the economic damages and non-economic damages of the person that your negligence injured.

Bodily injury insurance coverage is optional in Florida. No car driver or owner is required to purchase it. If a driver hits you with their car and they do not have bodily injury insurance coverage – you may have to make a decision about whether you can collect money from them personally.

Uninsured Motorist / Underinsured Motorist Insurance

Uninsured motorist (UM) coverage is a type of insurance that you can purchase to compensate you if another driver causes a car accident and injures you, but doesn’t have bodily injury coverage. Uninsured motorist coverage steps in and pays for your injuries as if the at-fault driver had bodily injury coverage. Any good accident lawyer would tell you to make sure that your insurance policy provides you with the protection of uninsured motorist coverage.

Comparative Negligence

Until March 24, 2023, Florida operated under a pure comparative negligence system. That meant that each party that is involved in a car accident is responsible to pay for their proportionate share of the damages caused. On March 24, 2023, Florida accident law changed (See House Bill 837). Now, Florida operates under a modified comparative negligence system. This means that if an accident victim is more than 50% responsible for causing their own damages, then they are completely prohibited from making any recovery against the other parties responsible for the crash (See Florida Statutes Section 768.81).

Evidence-gathering is a crucial aspect of this process because the plaintiff’s total compensation is reduced by the percentage of fault they bear. This is where help from our accident attorneys comes into play. In Miami car accident cases, it is crucial to prove that you are less than 50% responsible for causing your injuries or you will lose your case.

Leased Car Accident

Florida’s insurance requirements for leased vehicles are that you must have both property damage liability ($10,000) and bodily injury liability coverage ($20,000 per accident and $10,000/person). The requirement used to be $100,000/$300,000 coverage for bodily injury, but the Florida legislature reduced the amount of financial responsibility a person must have over a leased vehicle.

What Should You Do If You’ve Been Involved in a Car Accident in Miami?

It’s important to seek medical care immediately after a crash for any injuries to you, your passengers, or anyone else at the scene. Call 911 and ensure police and EMS are on the way. In many cases, crash victims may not feel any pain in the immediate aftermath of a crash.

Please understand that the signs and symptoms of many car accident injuries may not appear until hours or even days after the crash. Even if your injuries are not serious, you should let a doctor examine and diagnose you. By seeking medical attention immediately after a car accident, you are establishing a link between the crash and any injuries you sustained.

Steps to Take After a Miami Car Accident

- Document the scene if you are able to do so. Get out your smartphone and begin taking pictures of everything. This includes damages and injuries from the crash, the causes of the crash, traffic and weather conditions, and more. Speak to any eyewitnesses to the crash. Get their names and contact information so they can help with insurance issues or in a potential lawsuit.

- Make sure the police complete an accident report. Police officers will conduct their investigations and record their findings in the accident report. Be sure you know how to obtain a copy of this report for insurance or lawsuit purposes.

- Continue any medical treatment that your doctor prescribes. Discontinuing a treatment plan could jeopardize any settlement that you receive from insurance companies or in a lawsuit.

- Contact an experienced Miami car accident lawyer to give a free evaluation of your case. You may ask – If my injury isn’t that bad, should I get an attorney anyway? Yes, you should. It is often impossible to predict how an injury will progress and affect you in the future. By securing an injury lawyer for any injuries sustained in a car accident, you are protecting yourself. You can always drop your claim later if your condition improves.

The Importance of Uninsured Motorist (UM) Coverage in Miami

Navigating Miami’s busy roads comes with its fair share of challenges, and accidents are an unfortunate reality. What happens, though, when the responsible party doesn’t have insurance?

In Florida, drivers only are required to have Personal Injury Protection (PIP) and Property Damage Liability (PD) coverage. In very simple terms, PIP coverage pays for the medical bills of the person who paid for the coverage – regardless of who caused the crash. PIP is a no-fault insurance – which means it doesn’t matter who was at-fault. Property Damage insurance is a liability insurance. That means that the property damage insurance for the person who is liable for the crash will pay to fix the damage to the other party’s car or property.

It may sound unbelievable, but under Florida law, no driver is required to have bodily injury coverage – insurance to pay for the physical and emotional injuries that they negligently cause to a driver or pedestrian. Approximately 25% of the drivers in Miami do not have bodily injury insurance to cover injuries caused in a crash.

What do you do if you were hit by a driver that did not have bodily injury coverage?

Hopefully, you purchased an optional insurance coverage called Uninsured motorist (UM) coverage. UM is a highly recommended insurance coverage available from your car insurance company. It provides protection when an insured person is involved in an accident with a driver who lacks sufficient insurance coverage.

Uninsured motorist coverage is usually inexpensive and provides you with essential financial security in the event of an accident. However, many insurance agents have their clients waive their right to uninsured motorist coverage because it is not required and they try to get their clients the lowest possible premium – without considering the benefit of optional insurance coverages.

UM coverage steps in to cover medical expenses, lost wages, pain and suffering, disability, disfigurement, loss of the capacity to enjoy life, and other damages if you are involved in an accident with a driver who doesn’t have bodily injury insurance. In cases where the at-fault driver flees the scene (hit-and-run), UM coverage ensures you have financial protection for your injuries and damages.

Uninsured motorist coverage is a safety net that every driver should have, given the unpredictable nature of accidents on Miami’s roads. Our experienced car accident lawyers specialize in navigating complex insurance claims, including uninsured motorist cases. If you have questions about uninsured motorist coverage or need assistance with a car accident claim in Miami, don’t hesitate to reach out to our dedicated legal team for expert guidance.

Why Do You Need a Miami Car Accident Attorney?

If you were in an accident and there were no injuries involved, you may be able handle this on your own without an attorney. However, if you or a family member suffered a personal injury, this is where the right injury lawyer can usually help you get far more money from the insurance companies than if you were trying to handle this on your own.

A car accident attorney can help you evaluate your case and inform you of your legal options. Your attorney will be able to help you determine if an insurance company is offering you a fair settlement offer, and, if necessary, fight for your right to compensation in court.

Insurance companies often attempt to take advantage of car accident victims that do not have an attorney. Oftentimes, they will make unfair settlement offers to unrepresented claimants shortly after the accident.

This is an attempt to take advantage of victims who don’t have an attorney to represent them. You need a Miami auto accident lawyer to make sure that you get as much money as possible to pay for all of your past, present, and future medical bills that were a direct result of the accident, as well as other expenses.

Flanagan & Bodenheimer Car Accident Case Results

Below are some examples of car accident cases we have handled:

- $1,500,000 Car Accident Settlement: We represented a Broadway producer who was hit by a car while he was crossing a street in Palm Beach, Florida. As a result of our immediate investigation into the circumstances at the scene of the crash and our work to ensure that all insurance was discovered, we obtained a full, $1,500,000 car accident policy limits settlement for our client.

- $1,250,000 Car Accident Settlement: We were retained by the family of a GEICO insurance adjuster to help handle a wrongful death car accident case. Our client had a pre-existing brain injury for which he was using medical marijuana. At the time of the crash he was riding a motorcycle. The driver of an SUV made a left turn in front of our client causing him to crash into the side of the SUV. Our client died at the scene of the car accident. The defense disputed liability and claimed a marijuana intoxication defense. The insurance company for the SUV failed to disclose the amount of insurance on the SUV and failed to protect the driver of the SUV’s interests. After we filed suit, we learned that the SUV had $100,000 of insurance coverage. The insurance company offered the $100,000 in settlement. We rejected that offer and continued with our case until a settlement was reached for $1,250,000 – more than ten times the insurance policy limits.

- $800,000 Car Accident Settlement: We represented a woman who was involved in a rear-end crash with a man from Argentina. The Argentinian man claimed that a third car, that fled the scene, caused the crash. We were able to prove that the Argentinian man had been drinking on the night of the car accident and may have been intoxicated even though no police came to the scene of the crash and no breathalyzer or roadside tests were performed. Ultimately, approximately one year after the car accident our client underwent surgery performed by a leading neurosurgeon at University of Miami. After a hearing, the judge presiding over the case allowed a claim for punitive damages against the Argentinian defendant. The defendant appealed to the Third District Court of Appeals. We briefed the issue and won the appeal. After we prevailed on appeal, the Defendant’s insurance carrier paid $800,000.00 to settle the claim – more than 15 times the amount of our client’s medical bills.

- $500,000 Car Accident Settlement: We represented two women who were hit by a gardening truck while they were turning into a shopping center. The claim was initially handled by a different law firm prior to our involvement. That law firm made a reasonable offer to settle with the insurance carrier for the gardening truck for the $500,000 insurance policy limits. The insurance carrier rejected the offer and chose not to offer any money to settle. After a car accident lawsuit was filed, our law firm was retained to handle the litigation and trial of the case. Shortly after we began to litigate the case and take discovery, the insurance company agreed to pay the full $500,000 insurance policy limits to our clients.

Frequently Asked Miami Car Accident Questions

I was given a ticket or citation for the car accident, but it was not my fault, can I still file a claim?

Yes. Most people don’t know that the Florida traffic crash report is not admissible in evidence in your personal injury car accident case. Therefore, the ticket, the police report, and the opinions of the police officer as to what happened in the crash are not admissible. The exception to this rule is that if the police officer saw the crash occur, then they can testify to what they saw.

However, if the police officer came to the scene after the crash and issued you a ticket based on listening to the stories from the people involved in the crash, then the ticket is not admissible in your car accident personal injury case and the police officer cannot testify about his or her opinions about who caused the crash.

Will my insurance rates go up if I file a claim?

This is a very common question. The answer is that your insurance rates can be raised because you were involved in the crash – whether or not you file a claim. Your insurance carrier can even raise your rates because other people in your neighborhood were recently involved in crashes – even if you weren’t. Your insurance carrier should not raise your rates because you file a claim, but they may raise your rates because you were involved in a collision.

What happens if I choose not to submit my medical bills to my car insurance (PIP)?

If you chose not to submit your car accident injury medical bills to your car insurance, then the person who caused the crash will be entitled to a “set-off” or discount of $10,000 in your car accident injury case. Under Florida accident law, your car insurance carrier is required to pay your accident related medical bills up to $10,000.00. You are required to have this type of insurance coverage.

If you choose not to use this available benefit, then the defendant in your car accident injury case is entitled to a $10,000 discount on your medical bills, because you didn’t utilize your personal injury protection insurance.

Why Choose Flanagan & Bodenheimer As Your Car Accident Law Firm

In the aftermath of a serious car accident in Miami, selecting the right attorney is a critical decision. Here are a few reasons why clients trust Flanagan & Bodenheimer Injury and Wrongful Death Law Firm with their car accident cases:

- Exclusive Focus on Personal Injury: Our law firm is dedicated exclusively to handling personal injury and wrongful death cases in Miami, Florida. This specialization has enabled us to develop a profound expertise in these specific areas, distinguishing us from firms that disperse their focus across a range of practice areas.

- Small Caseload: Intentionally maintaining a small caseload, our law firm ensures that each client receives the personalized attention they need after a car accident. In contrast to larger firms where clients may feel like a number, our commitment to a small caseload guarantees direct access to your attorney when necessary, creating a more personalized and responsive legal experience.

- Tackling Complex Cases Declined By Other Firms: We take pride in our willingness to tackle difficult and complex cases that other firms may shy away from. Our track record demonstrates successful outcomes for clients who were turned away by other legal entities. If you’ve faced rejection elsewhere, our Miami car accident lawyer may be able to assist you. Contact us to discuss your case.

- Trial Experience: Our team of experienced car accident attorneys is ready to take cases to trial when required. Recognizing that not all cases reach a settlement outside the courtroom, our trial-ready approach ensures our clients receive adept representation in any legal setting, maximizing the chances of a favorable outcome. We have taken our clients’ cases to trial against many of the major automobile insurance companies.

For a free consultation with a Miami car accident lawyer, reach out to us at 305-638-4143 or complete our online form.

Contact Our Miami Car Accident Attorneys Today

Some evidence that is critical in a car accident case will be gone a short time after the crash. Video from cameras, EDR data, and 911 calls are just a few examples of the type of evidence that disappears shortly after a crash.

This evidence can make or break your case and it is important that you gather it immediately in your case. Our Miami car accident lawyers are experienced in gathering all types of evidence to build the strongest case possible. We’re also creative in our approach to cases and provide innovative solutions to get you the compensation you deserve.

When you suffer an injury in a car accident, you don’t have to face the courts or insurance companies alone. Our experienced personal injury attorneys have a history of protecting the rights of our clients through successful Miami personal injury claims. When you trust us with your claim, we’ll handle your legal matters so that you can focus on recovery.

Unlike many other Miami car accident attorneys, our attorneys have actually gone to trial against many of the major car insurance companies. We can handle your case from start to finish and give you and your case the attention and dedication you deserve.

Call or contact a Miami car accident lawyer immediately after you’ve been treated at (305) 638-4143. We’re pleased to offer free consultations.